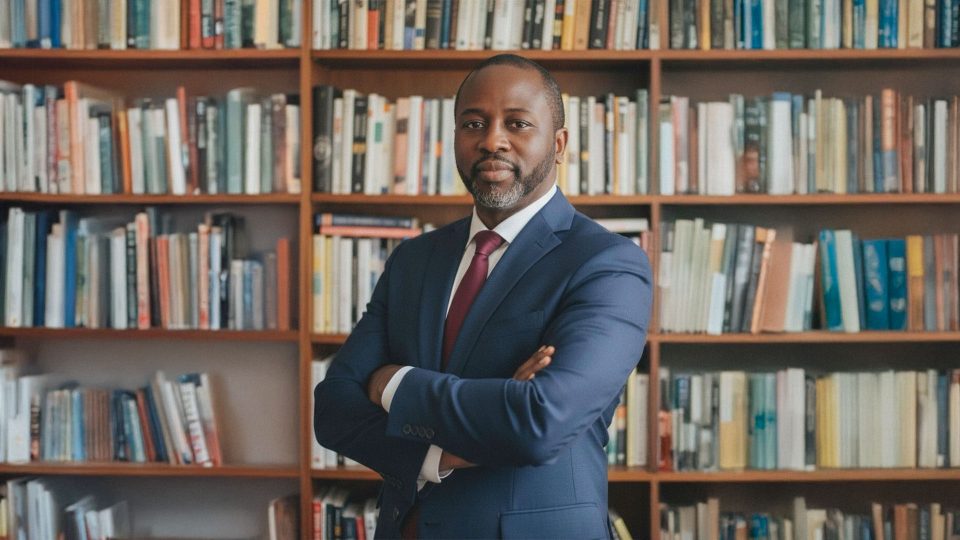

Artificial intelligence has transformed the way insurers assess, manage, and anticipate risk. The real competitive advantage does not come from replacing human expertise with machines, but from aligning both to enhance decision-making. With nearly three decades of leadership in underwriting, governance, and strategic advisory roles, Douglas Robare has been at the forefront of how emerging technologies are reshaping insurance and risk management.

“AI doesn’t replace judgment. It amplifies it when it’s used the right way,” says Robare, who outlines three guiding principles for aligning AI with human decision-making.

Know the Rules to Break Them

Robare’s first principle is to teach the system the framework, but empower people with the discretion to know when to depart from it without stripping away critical thinking. “AI learns the pattern. Humans understand the context,” he says. Models can capture data and identify trends across portfolios, but they lack the nuance of client relationships, brand positioning, and market dynamics.

In insurance, judgment is often about knowing when a deviation adds value or when consistency safeguards credibility. Robare emphasizes that this is where governance intersects with experience. AI can flag anomalies, but it is the human strategist who determines whether those anomalies represent risk, opportunity, or relationship-building moments.

Elevating Rules Instead of Eliminating Them

Robare notes that the true measure of an AI strategy’s business impact is its ability to clear obstacles. At its best, AI should simplify complexity while preserving, and sharpening critical thinking. “The best deployments don’t automate judgment, they automate what slows it down,” he says. Tasks such as data preparation, document review, and portfolio monitoring are ideal candidates for automation, allowing skilled professionals to devote their time to higher-value calls.

In practice, this shifts AI from being a tool of replacement to one of elevation. It strengthens the clarity of human decision-makers by removing distractions and letting them focus on the scenarios that truly move the business forward.

Embedding Context into Every Model

While AI excels at efficiency, it does not inherently understand an organization’s appetite for risk, its client strategy, or its long-term positioning in the market. Without those guardrails, the technology risks becoming detached from the values that underpin underwriting discipline.

“You can’t outsource philosophy,” he says. He encourages embedding leadership and context into every AI deployment. When insurers align models with strategic values, employees begin to trust and improve the system, rather than resist it. The outcome is not only operational efficiency, but cultural alignment around risk and innovation.

Balancing Speed with Judgment

Robare has built and led high-performing teams across multiple markets, often under significant regulatory scrutiny. Throughout all these experiences, he has consistently argued that technology must serve strategy, not the other way around. “We’re not replacing judgment with AI. We’re refining it, so it becomes faster, smarter, and more scalable,” he says.

The insurance industry is often accused of being slow to change, but Robare’s perspective is that bold, purpose-driven strategies can accelerate transformation without undermining trust. By teaching machines the rules, giving people the discretion to adapt them, and embedding organizational context, insurers can turn risk into a smarter, more resilient function.

“The future doesn’t belong to the machines or the humans. It belongs to both, aligned with purpose.”

To follow Douglas Robare’s latest insights on strategy, insurance, and AI, connect with him on LinkedIn or visit his website.